Department of Accounting Universitas Airlangga invited Dr. Mohd Zulkhairi Bin Mustapha from University of Malaya to give a guest lecture on October 14th 2021 hosted online via Zoom Conference. Dr. Mustapha talked about Tax Avoidance and Corporate Social Responsibility to around 168 undergraduate students. This guest lecturer intended to increase knowledge to undergraduate students specifically who are taking advanced management accounting course in the topic of tax avoidance and corporate social responsibility.

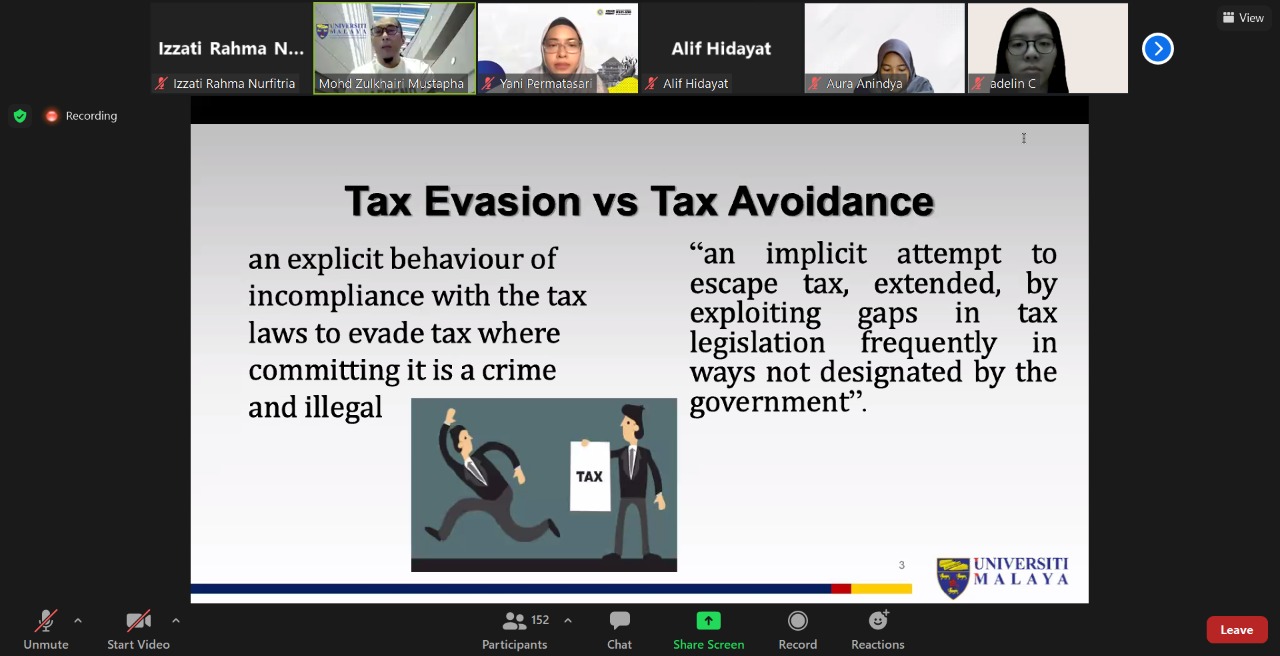

Dr. Mustapha began the presentation with intriguing quote about corporate social reporting: “corporate contribution, as part of society to benefit society, upon making profit out of doing business”. He then discussed about the concept of corporate social responsibility (CSR) that is broader than simple compliance with law. Social history is littered with laws which permitted slavery, discrimination, abuse of women, children and workers, but their shortcomings have been contested on moral, ethical, accountability, human rights and other grounds. CSR is frequently associated with promises of ethical and socially responsible conduct by businesses and its scope is increasingly being broadened. Arguably, few companies make any direct reference to payment of taxes in their social responsibility reports, but their claims of ethics, integrity, honesty, transparency and responsibility are meant to apply to all aspect of their operations.

He then explained that corporations have developed two cultures: one promises ethical conduct to external audiences and this is decoupled from the organisational practices which are geared to improving profits by avoiding and even evading taxes. In essence, companies have developed elaborate practices to appropriate returns due to society on its investment of social capital. The possibilities of social responsibility rest on the alignment of corporate culture with the social expectations that companies will honour their publicly espoused goals. He then conclude that the SDGs iniative will force companies to link between tax strategy and ESG.