Under uncertainty, there will be mismatching between the expenses and the revenues. This mismatching is inevitable because it is a reaction to uncertainty. Accountants need to be aware of uncertainty and mismatching, they need to be prudent and implement the right method in handling the mismatching carefully while evaluating the income statement. Professor of Financial Accounting, Columbia University, Stephen Penman, argued that uncertainty results in mismatching, and it is inevitable.

He mentioned it during the 1st Guest Lecture session with the theme: Accounting for Uncertainty on 24 May, 2021. The Guest Lecture session was moderated by the Assistant Professor of Accounting in Universitas Airlangga, Novrys Suhardianto, Ph.D.

“I once took a number of accounting courses back in University of Chicago and the first course was called “Principles of Accounting”. The professor in the course he attended explained on how accountants will use the matching principle where they match the expense and revenue, and it will be written in the income statement only when there is a customer. This is where Stephen Penman did not agree and thus started out his research on Accounting for Uncertainty. He found that under uncertainty, many accounting results in mismatching of the expenses. For example, the expenses of Research and Development in firms, the expenses are not to generate current revenues but future revenues. This may result in mismatching because the firm doesn’t know if it will be successful or not.

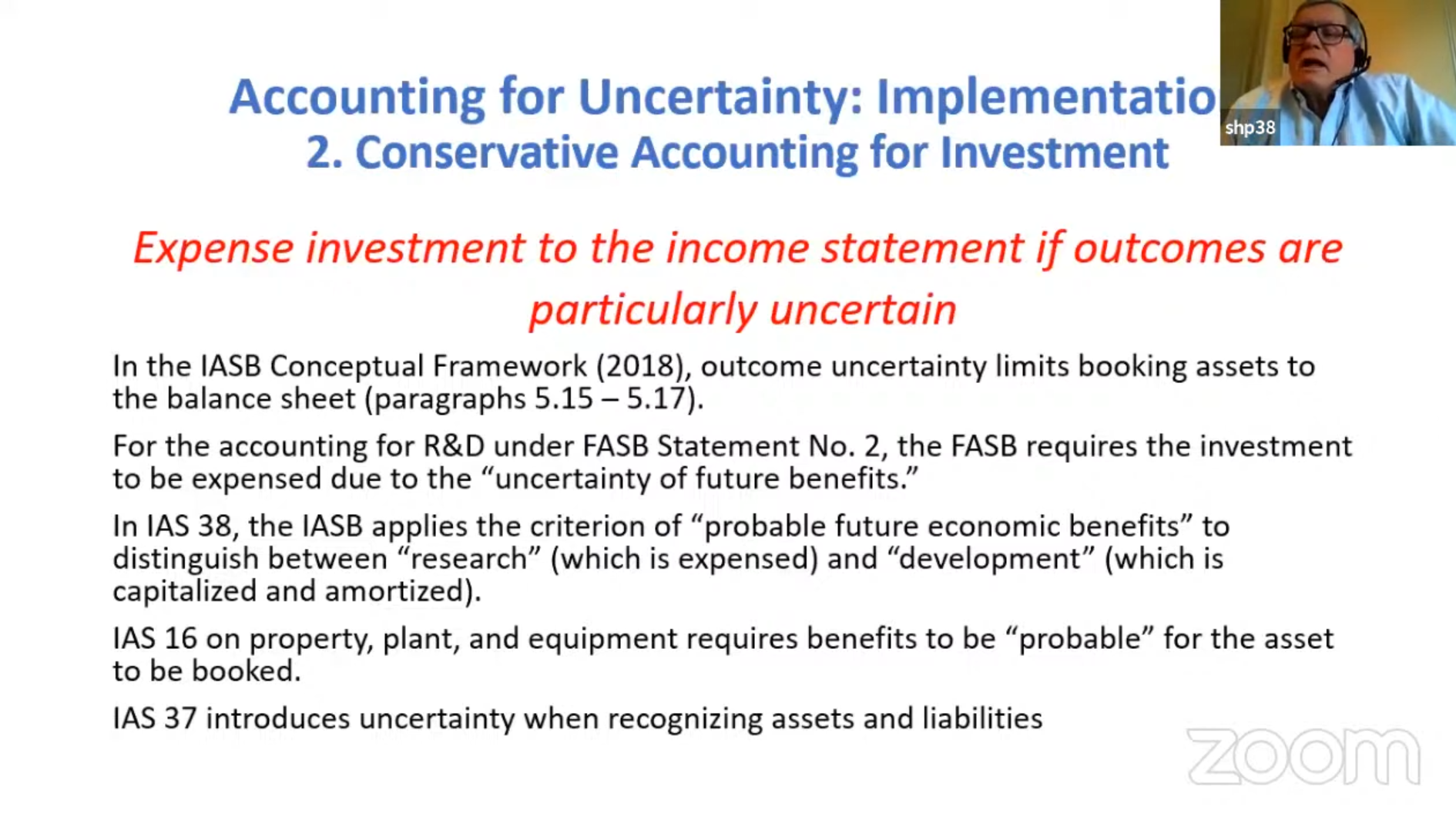

He explained that in Accounting for Uncertainty, there are two aspects of the implementation: the first one is earnings are revenues minus expenses in the income statement, but the revenue needs to be based on the realization principle. He mentioned that under FASB ASC 606 and IFRS 15, accountants can’t recognize earning until there’s been a satisfaction of a contract from both parties: the firm and customer, and also, receipt of cash needs to be “highly certain”, the firm needs to get a customer that shows high probability that they are going to pay. As an investor, we anticipate expected earnings but as an accountant, in facing uncertainty, we will not recognize earnings until there is realization, even when accountants have confirmed orders in the order book, because before it gets to that point of realization, earnings are deemed to be at risk. Secondly, accountants need to expense investment such as RnD expenses to the income statement if the outcome is highly uncertain.

He recalled the time when the professor in the course he attended explained on how accountants will use the matching principle where they match the expense and revenue, and it will be written in the income statement only when there is a customer. This is where Penman did not agree and thus started out his research on Accounting for Uncertainty. He found that under uncertainty, many accounting results in mismatching of the expenses. For example, the expenses of Research and Development in firms, the expenses are not to generate current revenues but future revenues. This may result in mismatching because the firm doesn’t know if it will be successful or not. He mentioned several expensed investments, such as: research & development, advertising, human capital investments, software investments and expenditures on customer loyalty programs, distribution and supply chain development, and organizational structure.

Furthermore, he mentioned that from the investor side, there will be a question about whether this is a price risk or not. But according to asset pricing theory, the risk that investors price is a risk that cannot be diversified away in a portfolio, or a systematic risk. The revenue recognition principle and conservative accounting for investments he mentioned before informs about the discount factor in general, no-arbitrage asset pricing model.

He explained that in handling mismatching, instead of matching the expenses and the current revenues, accountants need to have the expenses investments he mentioned before incurred to get general revenue or future revenue match to current revenue, and this needs to be handled carefully.

He also mentioned that the common proposal to remedy the mismatching is to capitalize the investments and book them for the balance sheet, and treat tangible as well as intangible assets the same. But there is an objection to capitalization, because by capitalizing expenses investments, it will lead to losing information about uncertainty. When accountants capitalize assets to the balance sheet, it must then be amortized, and then an amortization schedule needs to be established. Unfortunately, poor amortization creates mismatching. So, booking an asset to the balance sheet that was supposed to avoid mismatching can actually create mismatching, then the information of the earnings will be destroyed. He also explained that it is fine to have mismatching now because it avoids mismatching up-front, conveying risk.

He showed some examples from Twitter, Amazon and Facebook in how they had huge expenses but the expenses investments were being expensed directly to the income statement even when these investments were uncertain, because the customers have yet to be realized. This shows how important it is to recognize revenues only after there is a realization.

This guest lecture is available on the Departemen Akuntansi's YouTube Channel

(BLQ/DNH)