Professor of Accounting and Risk at the University of York, UK, Dr. Philip Linsey started off with two questions on the 4th Guest Lecture session that carries the theme: Understanding risk debates through Mary Douglas on 14 June 2021 and was moderated by one of the lecturers of Accounting in Universitas Airlangga, Dr. La Ode Sabaruddin.The questions are: why do different perspectives arise on difficult risk issues and why when the world is confronted with a number of catastrophic risks, does action not swiftly follow? He emphasizes that organizations need to be aware of the risks that they are facing.

At the beginning, he explained quite detailed information about the theory that was initiated by Mary Douglas, who was an anthropologist based in the UK. The theory had different names and different people like Michael Thompson and other researchers had shed more light on it. However, Dr. Philip prefers to call it the Neo-Durkheimian Institutional Theory. This theory raised 2 particular questions: why do different perspectives arise on difficult risk issues and why when the world is confronted with a number of potentially catastrophic risks, action does not swiftly follow.

He explained further that this theory can be applied to various fields like accounting regulations and other different ways. The basic idea of the theory is that we all have selective attention to risk, and what we mean by that is if i were to ask 1 to 5 top lists of risks that worry you most, you could write out those risks, and those risks they proposed could be different from one another. Mary Douglas was interested in how people see risks in different ways and how risks have different levels of concern, and how people don’t prioritize risk in the same way. She then created the foundation of theory: we are social beings, we want to live with people. Therefore, the risks we think are the most important are those that threaten the current pattern of social relations.

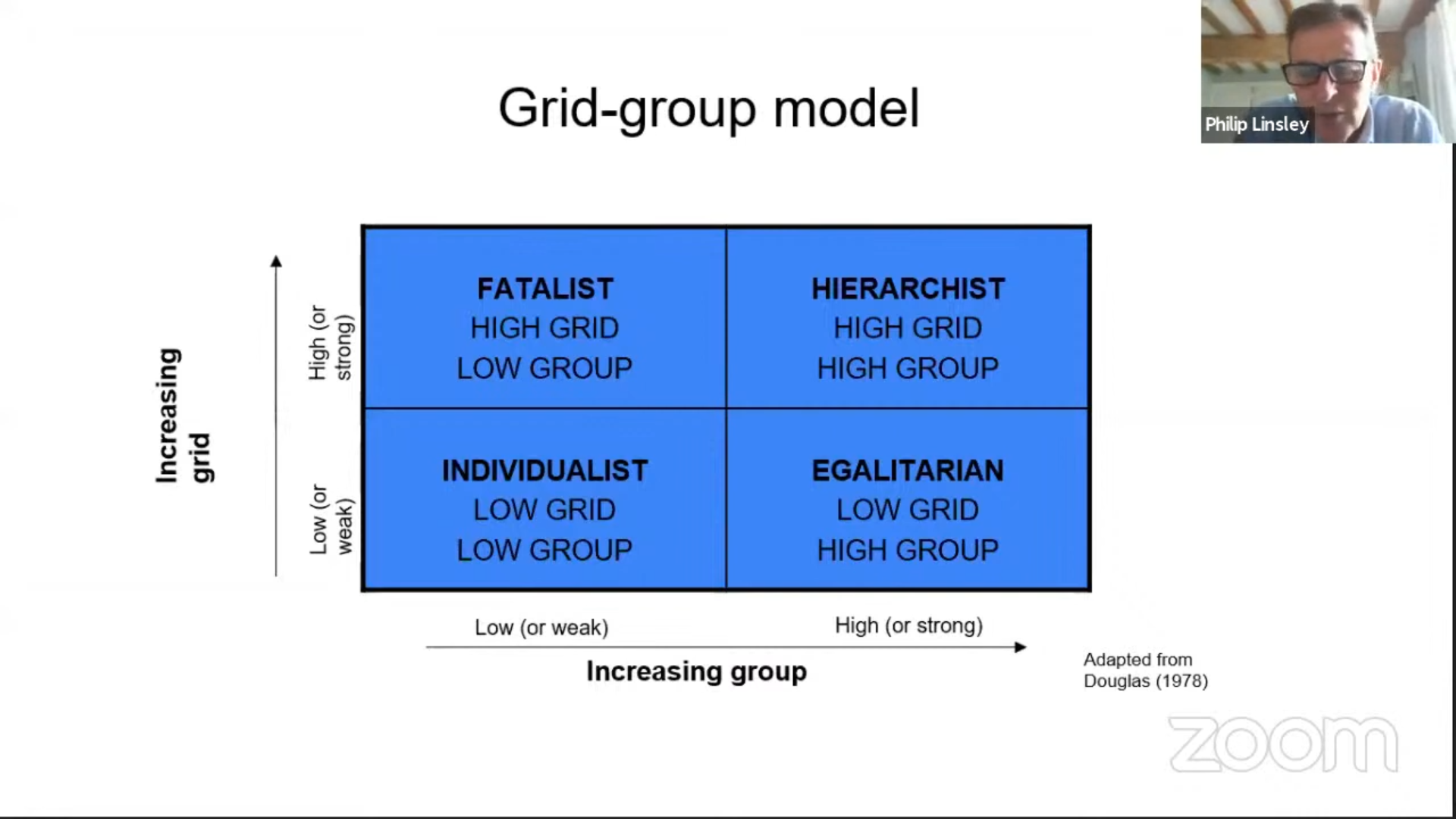

Risk is dependent on patterns of social relations, how we relate to one another. Hence, Mary Douglas created two dimensions in order to understand the theory. They are the group dimension which focuses on the degree of communication to other people in the community and the grid dimension which focuses on the amount of social regulation. Low or weak group has little commitment to others and your own aims are more important than the aims of the group, while a low or weak grid is when it is free to select your role in society as there is little social regulation.

Furthermore, he showed a diagram of a grid-group model from the theory. The diagram is divided into two squares: fatalist, hierarchists, individualist and egalitarian. It is then measured with how high or low the grid group they are. Mary Douglas argued within the society or group, you will get one of these two, this is a way of understanding the world. The high grid high group is hierarchist and the low grid low group is the individualist. Starting from fatalist, the characteristics are social roles confined, no sense of belonging, and the world is in an unpredictable situation. The next one, a hierarchist has the characteristics of strong external boundaries, clear internal boundaries and authority and traditions and rules are respected. Individualism has the characteristics of free to transact with whoever you want, self regulation preferred and failure are seen as a weakness of the individual. The last one, egalitarian, is when there is a strong external boundary, anyone disloyal to the group will be punished or expelled and it identifies the outside world as bad or unjust or unequal.

He also explained that these four factors impact on risk management. If you have to do risk management in your work or assignments or any tasks, the way you see the world can affect the way you handle risk management. For the fatalist, what they say is that they look to keep options open and adapt strategies as uncertainties arise and all risk management systems will eventually be found to be inadequate. Hierarchist on the other hand prefer to carefully balance risk and reward, and have the preference for comprehensive risk management systems developed by experts. Individualists prefer to not be in favor of comprehensive risk management systems as they impede innovation and risk-taking while egalitarians look to avoid losses. He showed many examples of views that can be seen from these four perspectives such as the poverty debates view, nature view and even Covid-19 view.

This guest lecture is available on the Departemen Akuntansi's YouTube Channel

(BLQ/DNH)